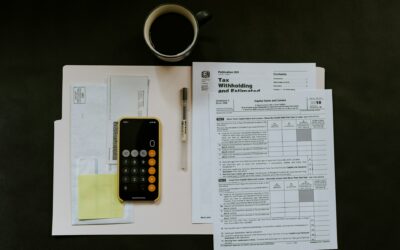

Most of the tax document mailings you will receive over the next few months fall within the 1099 series of forms. Many of them are used to report payments or transaction to the IRS and need to be filed with your tax return. Be sure to have the forms on hand when you are preparing your taxes yourself or provide the forms with all other tax related documentation when you meet with your tax preparer.

Related: 2022 Wrap Up: 7 Year-end Tax Planning Questions to Consider

Tax Document Mailings: Terms You Need to Know

There are several types of Form 1099 documents that begin arriving in late January and February. Here are just a few of the most common ones you might receive:

1099-B: Brokers or mutual fund companies must send this form when you sell stock. It shows the amount and date of the sale, and provides cost basis information if supplied to the company.

1099-DIV, Dividends and Distributions: This form must be filed if you own stock or other securities and receive over $10 in distributions, such as dividends, capital gain distributions, or nontaxable distributions, that were paid on stock and liquidation distributions.

1099-G: Use this form to report unemployment compensation, state and local income tax refunds, agricultural payments, and taxable grants.

1099-INT, Interest Income: Financial institutions are required to send you this form if they pay you more than $10 in interest during the year.

1099-LTC: Long-Term Care and Accelerated Death Benefits. Will show distributions made from these types of contracts.

1099-MISC: This form must be filed if you pay an independent contractor at least $600 for professional services during the year.

1099-Q: File this form if you receive payments from qualified education programs (Under Sections 529 and 530).

1099-R: This is the form filed when you get a distribution from a retirement plan, such as an IRS, Roth IRA and 401(k) plan.

1099-S: Use this form when reporting proceeds from real estate transactions.

SSA-1099: Reports Social Security benefits received from the Social Security Administration.Not to be confused with Form 1099-R, which reports retirement benefits received from non-SSA sources, such as a pension or an IRA.

1099-SA: Distributions From an Health Savings Account, Archer MSA, or Medicare Advantage MSA

If you receive a 1099 form not listed above you can visit the IRS.gov website or ask your tax preparer for information.

Related: 5 Tips to Help You Save On Taxes and Build Savings

Some 1099’s that are reporting dividends may also come in a corrected form after February. If you receive updated 1099’s and you have already filed your taxes, make sure you have updated information into your tax preparer as soon as you receive them.

Make Sense of Your Tax Document Mailings with Clarity

We’re here to help you tackle tax planning no matter the season. Click here to connect with a member of the Clarity team today to get started.